Identify investors who are aligned with your strategic IR goals

This investor targeting guide covers:

Key benefits of active investor targeting

Investor targeting is a key element of a successful investor relations strategy. Forming core institutional shareholder base of long-term oriented actively managed investment funds whose managers have a sound understanding of your business and industry will be hugely beneficial to successfully execute your investor relations strategy.

This group of educated investors will be aligned with your strategic thoughts. Beyond having a solid understanding of your company’s potential, challenges, and opportunities, as well as the right approach to deriving your company’s fair value, they offer to be valuable discussion partners and serve as a beacon for investors with similar investment philosophies.

Beyond searching for beacon investors, your investor targeting strategy should also address your thoughts on shareholder diversification. A diversified shareholder base will help reduce volatility as it buffers from exogenic shocks should one group of investors uniformly have decided to shift their focus for reasons outside of your control.

Analyse your current investor base

To identify potential gaps in your shareholder universe, the first step is to understand the composition of your current investor base. Scrutinize your ownership along the following criteria:

Shareholder composition by stakeholder type

Typical investor types are:

- Strategic investors not available to the free float

- Employees and management

- Retail

- Investment advisors

- Family offices

- Long-only active institutional investors

- Long-only passive institutional investors

- Hedge funds

Shareholders by nationality

Shareholders by investment style

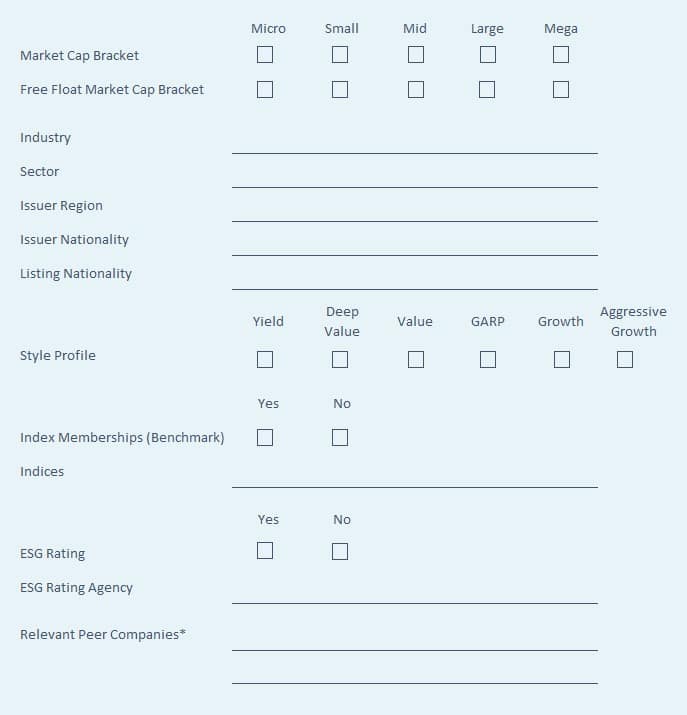

A meaningful classification of styles is Yield, Deep Value, Value, GARP, Growth, Aggressive Growth

Concentration of your institutional investors

Top 10, Top 25, Top 50, Rest

Number of invested funds

Investment per fund

High, low, mean, average

Weighting of your company in portfolios

Overweight, Neutral, Underweight

Recent sellers and buyers

Look for common criteria among the sellers and buyers

Understand how investors will look at you

To prepare your target investor identification, you will want to have a clear understanding of the investment criteria your target audience needs to be receptive for to take an interest in investing into your company. The best approach is to map generic elements of your investment story to common guidelines of investment funds. You can use the below checklist for an orientation:

Target investors who are right for you

A merged shareholder list of investors in a defined group of relevant companies will be a good starting point. You can use the checklist above as a an orientation to look for relevant companies. This list will differ from a group of peer companies you would select to compare your multiple valuation to that of your peers.

If your reference group only comprises your industry peers you will likely end up pitching to investors to replace and existing investment with one into your company. After all, very few funds take a narrow approach to invest into a narrowly defined range of sectors. Investment portfolios are much more likely to consider a certain risk/return profile within a defined region and (free float) market cap range. A broader approach to relevant companies for the purpose of investor targeting will provide you with an improved target universe.

The merged shareholder analysis is a top down approach. Subject to your market cap definition and the number of relevant comparable companies, you will be confronted with a very long list of potential targets. For a detailed, bottom-up view, use the investment criteria you have defined above to scrutinize the universe of investors who are eligible to invest in you.

Investor targeting is portfolio targeting

The portfolio’s composition and investment parameters decide the portfolio fit of your company and will also point you into the right direction for the relevant contacts to start a relationship with.

Scrutinizing the output along the list of investment criteria will help you understand the portfolio fit and to segment your target audience. Define segments with common criteria for a possible portfolio fit by clearly stating why an investor of a particular segment will want to consider an investment into your company.

To prioritize your target investors, it will be helpful to understand the investment potential of each portfolio and decision maker as well as to be able to qualify the quality of the investment fit.

Tools which apply artificial intelligence to tackle the big data problem can help you save time and yield better results. For more information, please see our article in the IR Magazine or view our 15-minute webcast about the inner workings of machine learning for investor targeting.

Set your goals

Setting your goals requires a combination of a top-down and bottom-up approach. The top-down approach will describe your scenario for an ideal shareholder composition.

Top-down criteria

Thought process

Composition by stakeholder type

What is my desired mix of retail, semi-institutional and institutional shareholders?

Which split of family offices, investment advisors, institutional long-only and hedge fund investors would I prefer?

Would I like more employee involvement?

Regional diversification

What is a good regional split between institutional investors for my investment case?

Investment style focus

Which investment style should be prevalent among my institutional group of shareholders?

Niche orientation

Are there specific investment objectives of a fund which will favour an understanding of my company?

ESG

Do my E, S & G strategies and reporting fulfil the requirements of dedicated portfolios? Do I have to rule out certain potentially aspirational shareholders because I would not fit to their ESG requirements?

The bottom-up approach is the result of the target list you have produced by strategically researching large quantities of data using the processes described above. Ranking your list according to investment potential as well as quality of fit will provide you with a good idea of medium-term aspirational shareholders versus some potential quick wins. Your segmentation of the universe of target investors will allow you to map your target investors to your top-down goals. Those target investors mapped to your goals compared to your current shareholder base form your gap analysis.

Plan your engagement strategy

Once you have identified, segmented, and prioritized your target investors you have completed the first important steps in active investor targeting. Planning your engagement strategy is the next step.

There are three principal ways to create initial touch points with your prospective institutional and quasi-institutional investors, conferences, broker-organized investor meetings and direct investor outreach.

When planning your year, you will have identified investor conferences who are most relevant to you. Make a note next to the investors you expect to be present at those conferences to make sure to try to meet the right investors and make the most of your conference attendance.

Challenge your brokers about the quality of their relationship with your target audience. Map each target investor to the broker with the strongest ties and make sure your broker is aware that meetings with investors who are strategically interesting and identified by you is a key criterion when measuring the broker’s performance.

Address changing touchpoints

Regulatory changes, most notably MiFID II, and encompassing budgetary constraints at the level of the institutions have led to a situation where the brokers’ reaches into institutions have become much more selective. Many institutional investors do not mind or even favour the direct approach by companies. Bilaterally agreed meetings do not eat into the institutions budget for concierge services to brokers or conference attendance. Furthermore, the larger institutions have established corporate access desks serving as a central point of entry for listed companies seeking to meet portfolio managers and buy side analysts.

When directly reaching out to an identified contact person at your target institution you can use traditional tools such as the telephone or email, social media or use a direct investor access tool dedicated to investor relations. Having segmented your target investors will help you prepare a personalized 30 second to the point pitch which will capture your audience’s attention. For more information on direct investor access tools, refer to our article on direct investor access.

Monitor results of your investor targeting approach

Having successfully established a contact with your aspirational investor is the start of a journey. You cannot expect any serious professional investor to invest after the first meeting. Your target investor has just become a lead. To follow your target investor through the investor journey it is important to be able to monitor the results. Each new touch point should also provide additional insights to you and help you understand the investor better to successfully plan the next step.

Your meaningful meeting notes will be a valuable source of information. To further personalize the next meeting, you may also want to attach some private notes to your contact.

Unleash direct investor feedback

The most valuable source of information will be actionable feedback you receive from the investor directly. During a recent webinar (German language only), we asked IROs about the relevance and source of investor feedback.

Interestingly, during the same IR conference in various other webinars several institutional investor representatives repeatedly voiced their surprise that they are not more often approached by companies to ask for their opinion. The best way to receive actionable results and continuously monitor investor sentiment will be a bilateral approach to feedback. For more information on how to generate meaningful investor feedback, please see our related article.

Consistently monitoring movements in your shareholder base will allow you to analyse your results, track conversion, and help with re-engagement of existing or past investors.

Useful tools

The days where brokerage firms were the central points of entry to market intelligence and investor access are long gone. Today, you have the option to choose from a variety of tools to help you identify relevant target investors and support your investor engagement process. Used well, these tools save you time and increase the overall efficiency and effectiveness of your team while at the same time making you less reliant on brokerage firms and allowing you to use your sell-side relationships more effectively.

Summary

Identifying investors who are right for your company is an important element of strategic investor relations. It helps support valuation, reduce volatility, and contributes to the long-term success of your company’s investor experience.

Getting the identification of the right target investors right requires a thorough analysis of your current shareholder base, a precise approach to market screening and a clear vision of your IR goals.

Today’s tech tools will offer you valuable support and put you in a position to leverage your sell-side contacts to the maximum.

Investor targeting initiates an investor journey which can be assisted by data through consistent monitoring and direct investor feedback to increase your chances of your targets converting to leads and from leads to long-term shareholders.

Related services by ACCNITE

- Equity story design

- Investor gap analysis

- Target shareholder identification

- Investor engagement strategies

- Sentiment analysis

- Investor relations SaaS solution

- IR CRM

- Shareholder analysis

- AI based investor targeting

- Direct investor outreach

- Bilateral feedback